rhode island income tax withholding

An Official Rhode Island State Website. An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

Rhode Island Analyzes Two Year Study Considers Combined Reporting

The annualized wage threshold where the annual exemption amount is.

. The income tax withholding formula for the State of Rhode Island will include the following changes. Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. The income tax withholding for the State of Rhode Island includes the following changes.

The annualized wage threshold where the annual exemption amount is eliminated. RI Department of Labor and Training. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

RHODE ISLAND EMPLOYERS INCOME TAX WITHHOLDING. Some Employers Will Be. Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of.

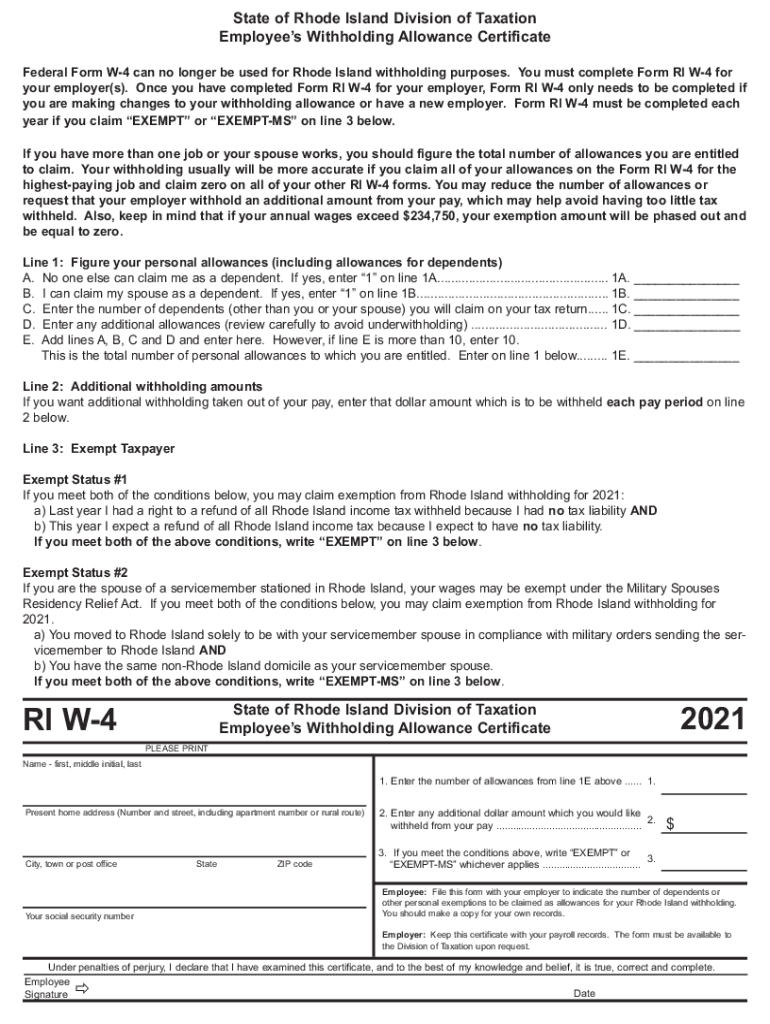

The income tax withholding for the State of Rhode Island includes the following changes. The income tax withholding for the State of Rhode Island includes the following changes. Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Residents and nonresidents including resident and. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax.

A the employees wages are. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Forms Toggle child menu. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the.

REPORTING RHODE ISLAND TAX WITHHELD. Ad Fill Sign Email RI RI W-4 More Fillable Forms Register and Subscribe Now. The annualized wage threshold where the annual exemption amount is eliminated has changed.

Personal Income Tax - Employers Withholding. Some employers will be required to file and pay RI withholding tax by electronic means. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the.

Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. The income tax is progressive tax with rates ranging from 375 up to. The annualized wage threshold where the annual exemption amount is eliminated.

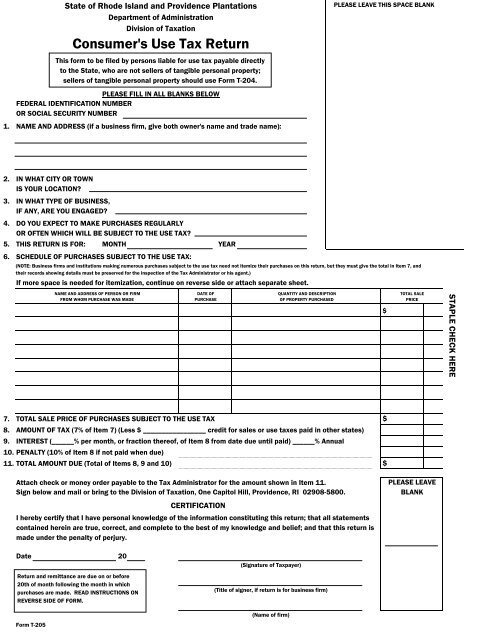

The mailing address for tax returns payments and other correspondence for the Employer Tax unit is now. Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. New Form RI-941 Is To Be Filed On Or Before The Last Day Of The Following Month.

Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Form RI-941 is to be filed on or before the last day of the following month.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

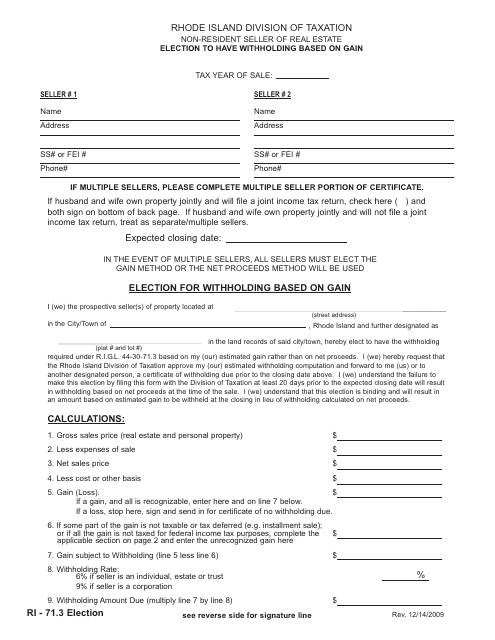

Form 71 3 Download Printable Pdf Or Fill Online Non Resident Seller Of Real Estate Election To Have Withholding Based On Gain Rhode Island Templateroller

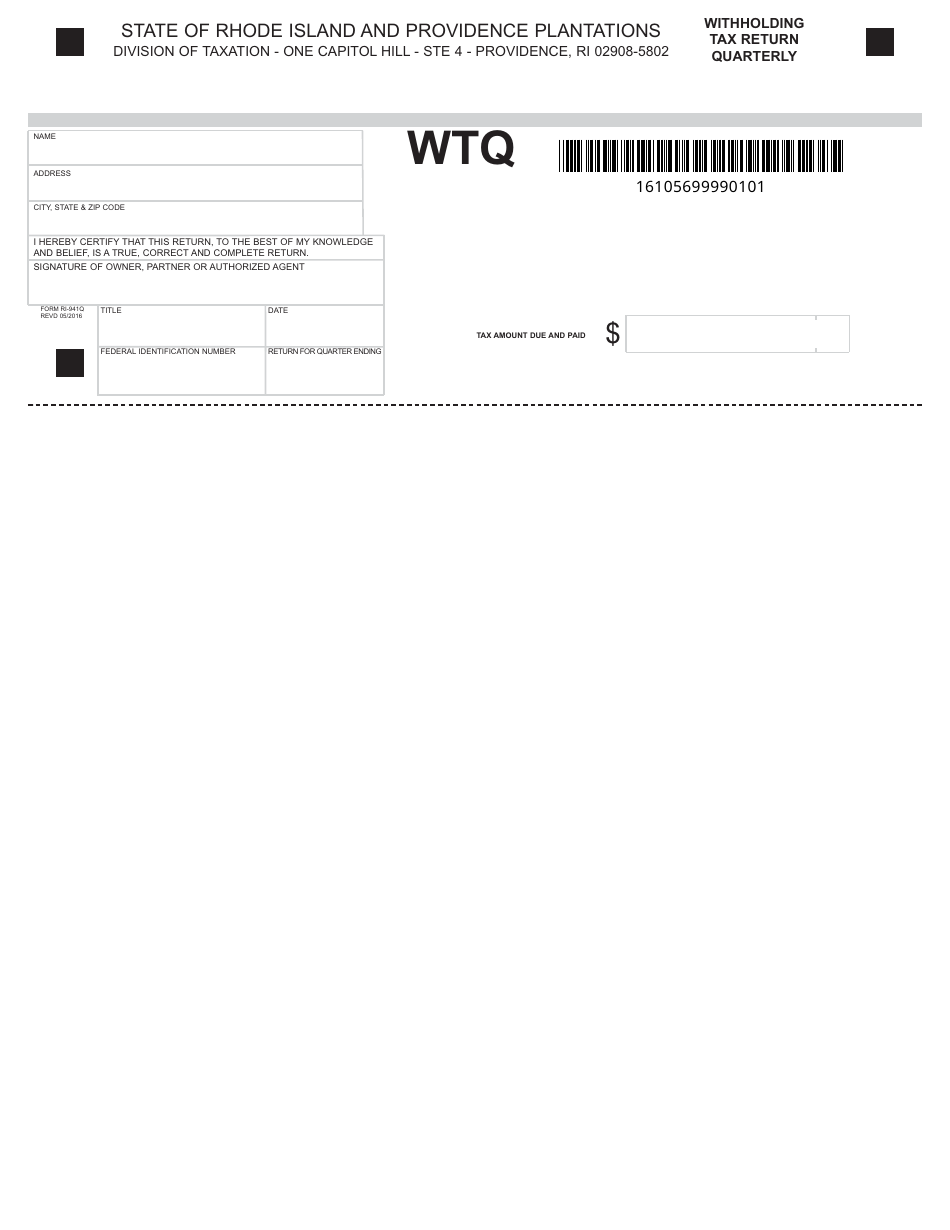

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

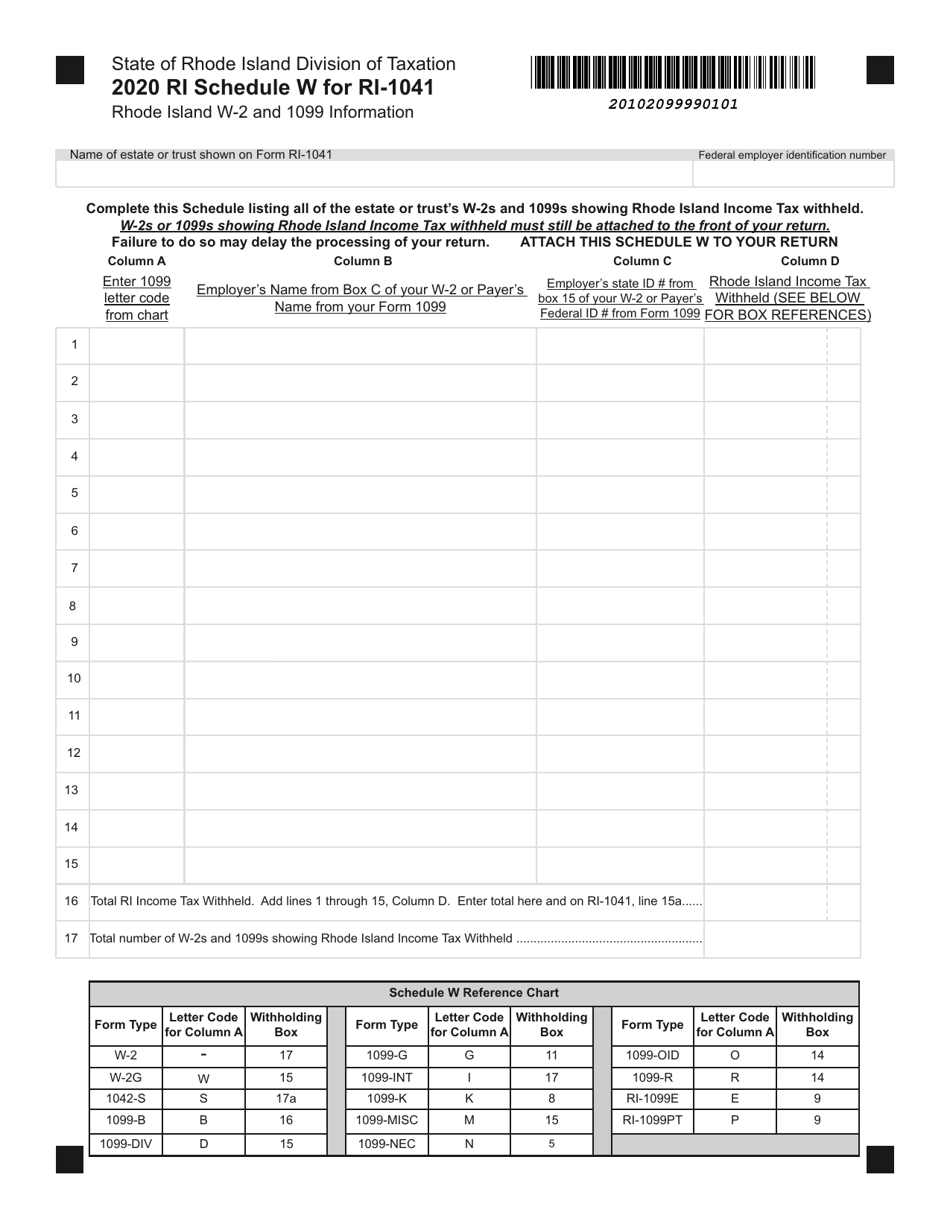

Form Ri 1041 Schedule W Download Fillable Pdf Or Fill Online Rhode Island W 2 And 1099 Information 2020 Rhode Island Templateroller

True Cost To Start A Rhode Island Llc Optional Required

Rhode Island Crime News May 2022 The Boston Globe

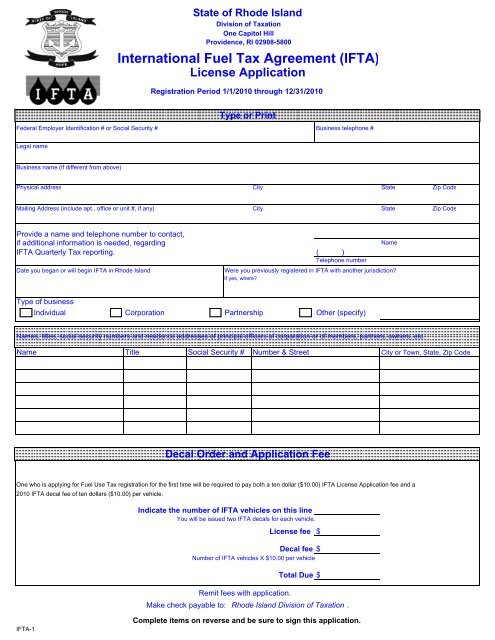

International Fuel Tax Agreement Ifta Rhode Island Division Of

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Ri Ri W 4 2021 2022 Fill And Sign Printable Template Online

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

Download Rhode Island Division Of Taxation

Rhode Island Income Tax Brackets 2020

Contact Us Ri Division Of Taxation

Rhode Island Income Tax Ri State Tax Calculator Community Tax